What We Do

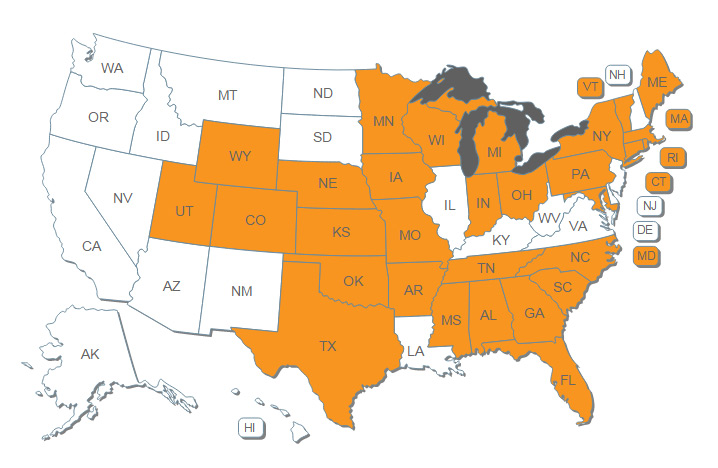

Energy Impact, LLC’s main area of expertise is in obtaining utility sales tax exemptions and refunds for companies’ consumption of energy used in the manufacturing and production process. In 30 states, when your utilities are “necessary and integral to production” you do not have to pay sales tax on those utilities. The utility sales tax exemption is state legislation that is used as an economic incentive to encourage manufacturing and production within the state. Manufacturers are entitled to this utility sales tax exemption, and it could save your company substantial tax dollars moving forward.

In order to obtain utility sales tax exemptions, our firm specializes in performing the required engineering study at your facility on applicable utility meters. This creates an immediate and permanent savings on utility bills each month. Additionally, retroactive studies can be performed to recover all utility sales taxes paid on the meter. Depending on the size of the utility bills, this can be a considerable amount of savings for a manufacturer.

Our Approach

- Qualify all production meters, machinery and equipment by taking a detailed facility tour.

- Separate production versus nonproduction usage on the utility meter to determine the percentage of the utility used in the production process. Perform a predominant use study in applicable states.

- Reduce or eliminate monthly utility sales tax payments. In many states, this is a permanent exemption.

- Prepare and submit all necessary exemption and refund forms and documentation.

- Apply for all available utility sales tax refunds.

- Provide documentation to the client to support the exemption percentages and refund calculations.

Energy Impact conducted a full-scale utility audit for our firm. Their audit saved us nearly 10 percent on our electric bills going forward permanently. Plus, they were able to recover a significant amount of money going back over historical invoices – this money was like receiving a windfall! Thank you Energy Impact.

Who can qualify for the utility sales tax exemption?

- Manufacturers

- Industrial Processors

- Recyclers

- Automated-Assembly Fabricators

- R&D Facilities

- Agriculture

- Mining Facilities

- Restaurants (select states)

- Nonprofit Organizations (select states)

Sales Tax Exemptions available for the following:

- Electric

- Natural Gas

- Water

- Steam

- Industrial Gases

Case Studies:

Learn how Energy Impact has helped companies save thousands on their utility taxes.

Get In Touch

Want to see if your company qualifies for additional tax credits? Click the button below and complete our brief form.